Every so often I'll have a conversation or a specific valuation problem to solve, that engenders a specific thought or two. I'll post some here to share, keeping all names confidential. If you have a specific question you would like to ask, please do.

Phone: (208) 749-3116 - Email: [email protected]

April 4, 2023 - Costs of Capital for Privately Held Businesses

This month’s topic is going to be a heavy one, so if you want a lighter read from me this month, I suggest you check out some of my prior posts. For those of you who want to get deeper into the weeds on this topic, here we go!

In this posting, I am assuming that my readers have a good understanding of the basics regarding business valuation theory and the various puzzle pieces that one may use to complete an analysis. I am going to bold certain lines below that you may want to pay attention to. These are assumptions that will be affecting the overall theme of this post.

‘Cost of Capital’ is a topic that is of interest to a variety of business professionals besides appraisers. One of my readers had suggested that I write up a discussion on those three words and what they mean for us as business appraisers. (This is all your fault, Michael!) I’m discussing a variety of options a business appraiser has for calculating a discount rate, and I mention some of the ins and outs of those options below. If you would like to discuss any of these topics in further detail, feel free to reach out.

To start out, I Googled ‘Cost of Capital’ and found a link to the Harvard Business School with the following definition:

"Cost of capital is the minimum rate of return or profit a company must earn before generating value. It’s calculated by a business’s accounting department to determine financial risk and whether an investment is justified.

Click here to see the whole post!

This month’s topic is going to be a heavy one, so if you want a lighter read from me this month, I suggest you check out some of my prior posts. For those of you who want to get deeper into the weeds on this topic, here we go!

In this posting, I am assuming that my readers have a good understanding of the basics regarding business valuation theory and the various puzzle pieces that one may use to complete an analysis. I am going to bold certain lines below that you may want to pay attention to. These are assumptions that will be affecting the overall theme of this post.

‘Cost of Capital’ is a topic that is of interest to a variety of business professionals besides appraisers. One of my readers had suggested that I write up a discussion on those three words and what they mean for us as business appraisers. (This is all your fault, Michael!) I’m discussing a variety of options a business appraiser has for calculating a discount rate, and I mention some of the ins and outs of those options below. If you would like to discuss any of these topics in further detail, feel free to reach out.

To start out, I Googled ‘Cost of Capital’ and found a link to the Harvard Business School with the following definition:

"Cost of capital is the minimum rate of return or profit a company must earn before generating value. It’s calculated by a business’s accounting department to determine financial risk and whether an investment is justified.

Click here to see the whole post!

March 14, 2023 - Keeping an Open Mind

There are a LOT of different types of businesses out there, each with different characteristics that affect how they can be appraised.

As business appraisers, we run into businesses with poor financials, detailed financials, businesses that operate in multiple industry codes, businesses that are very profitable, and others that are losing money every year. We see businesses that hold excess assets, some that only hold assets and never generate a dollar of income. There are businesses that operate as non-profits, C-corporations, S-corporations, sole proprietors, Limited Liability entities, or partnerships and some that have never filed a tax return.

We could be asked to appraise any of these businesses for a wide variety of purposes ranging from a 100% controlling interest to any size of a non-controlling ownership interest. There could be a partner dispute, or maybe a partner wants to buy in. We could be appraising the equity position or an invested capital interest in a business. We could be asked to appraise a 100% interest in the assets that typically transfer in a sale or we could be asked to appraise a non-controlling equity interest in a holding company.

All of these factors can have an effect on how we reach our value conclusions.

Click here to see the rest of the post!

There are a LOT of different types of businesses out there, each with different characteristics that affect how they can be appraised.

As business appraisers, we run into businesses with poor financials, detailed financials, businesses that operate in multiple industry codes, businesses that are very profitable, and others that are losing money every year. We see businesses that hold excess assets, some that only hold assets and never generate a dollar of income. There are businesses that operate as non-profits, C-corporations, S-corporations, sole proprietors, Limited Liability entities, or partnerships and some that have never filed a tax return.

We could be asked to appraise any of these businesses for a wide variety of purposes ranging from a 100% controlling interest to any size of a non-controlling ownership interest. There could be a partner dispute, or maybe a partner wants to buy in. We could be appraising the equity position or an invested capital interest in a business. We could be asked to appraise a 100% interest in the assets that typically transfer in a sale or we could be asked to appraise a non-controlling equity interest in a holding company.

All of these factors can have an effect on how we reach our value conclusions.

Click here to see the rest of the post!

January 10, 2023 - Why Do We Do What We Do? - Comparative Financial Analysis Edition

Happy New Year!!

As Business Appraisers, we look at a lot of numbers. We examine financial statements and tax returns so we can identify historical trends, and help identify risk drivers, but I have noticed quite a few reports this last year where the appraiser omitted a comparative financial ratio analysis. I thought I’d start off this year’s newsletter with a discussion on this basic analysis.

Revenue 59-60 lists as one of the eight factors we are to consider in the valuation of a privately held business as, “The book value of the stock and the financial condition of the business.” If all we look at is the subject company’s financial data, we are only going to see the part of the picture that the subject company portrays. If we also compare the subject company’s data to industry averages, then we can really see how the Company has been performing amongst its peers. If a business’ ratios indicate that it is underperforming, then we can draw the conclusion that the subject business may have higher operating risk. If the industry ratios are showing the subject business to be performing better than average, then we can use that to support the selection of a higher than average market multiple and also a lower discount rate.

Click here to see the rest of the post.

Happy New Year!!

As Business Appraisers, we look at a lot of numbers. We examine financial statements and tax returns so we can identify historical trends, and help identify risk drivers, but I have noticed quite a few reports this last year where the appraiser omitted a comparative financial ratio analysis. I thought I’d start off this year’s newsletter with a discussion on this basic analysis.

Revenue 59-60 lists as one of the eight factors we are to consider in the valuation of a privately held business as, “The book value of the stock and the financial condition of the business.” If all we look at is the subject company’s financial data, we are only going to see the part of the picture that the subject company portrays. If we also compare the subject company’s data to industry averages, then we can really see how the Company has been performing amongst its peers. If a business’ ratios indicate that it is underperforming, then we can draw the conclusion that the subject business may have higher operating risk. If the industry ratios are showing the subject business to be performing better than average, then we can use that to support the selection of a higher than average market multiple and also a lower discount rate.

Click here to see the rest of the post.

December 13, 2022 - Explaining the Build-Up Method

Merry Christmas, Everybody!

This is a question I get asked several times a year, and I thought I'd expand on it here as a good wrap-up to the year. Most likely, you won't be seeing any more newsletters from me for the rest of this year, so I hoped to make this one a good one. :-)

The Build-up method is one of the most commonly used techniques, for estimating the risk rate applicable to the valuation of a privately held business. As business appraisers, we know where to get the data to provide the Risk-free rate, the Equity risk premium, the Size premium, and all about what goes into the selected Specific company risk premium (SCRP). I know we all love the SCRP!

But…when one of our readers asks us, “what do all these different rates mean and how do they apply to the valuation of my business?”

Here is how I answer that question:

“The value of a business is equal to its expected future earnings divided by the risk of achieving those earnings. On the one hand, we have our forecast of expected future earnings, now we just need to figure out what the hypothetical, willing and able buyer might expect and a hypothetical, willing and able seller might accept.”

(It was so much easier just linking the newsletter to my blog postings for last month, so I am going to start doing that each time. Click here to read the rest of my post.)

Merry Christmas, Everybody!

This is a question I get asked several times a year, and I thought I'd expand on it here as a good wrap-up to the year. Most likely, you won't be seeing any more newsletters from me for the rest of this year, so I hoped to make this one a good one. :-)

The Build-up method is one of the most commonly used techniques, for estimating the risk rate applicable to the valuation of a privately held business. As business appraisers, we know where to get the data to provide the Risk-free rate, the Equity risk premium, the Size premium, and all about what goes into the selected Specific company risk premium (SCRP). I know we all love the SCRP!

But…when one of our readers asks us, “what do all these different rates mean and how do they apply to the valuation of my business?”

Here is how I answer that question:

“The value of a business is equal to its expected future earnings divided by the risk of achieving those earnings. On the one hand, we have our forecast of expected future earnings, now we just need to figure out what the hypothetical, willing and able buyer might expect and a hypothetical, willing and able seller might accept.”

(It was so much easier just linking the newsletter to my blog postings for last month, so I am going to start doing that each time. Click here to read the rest of my post.)

November 8, 2022 - That First Phone Call from a Potential Client...

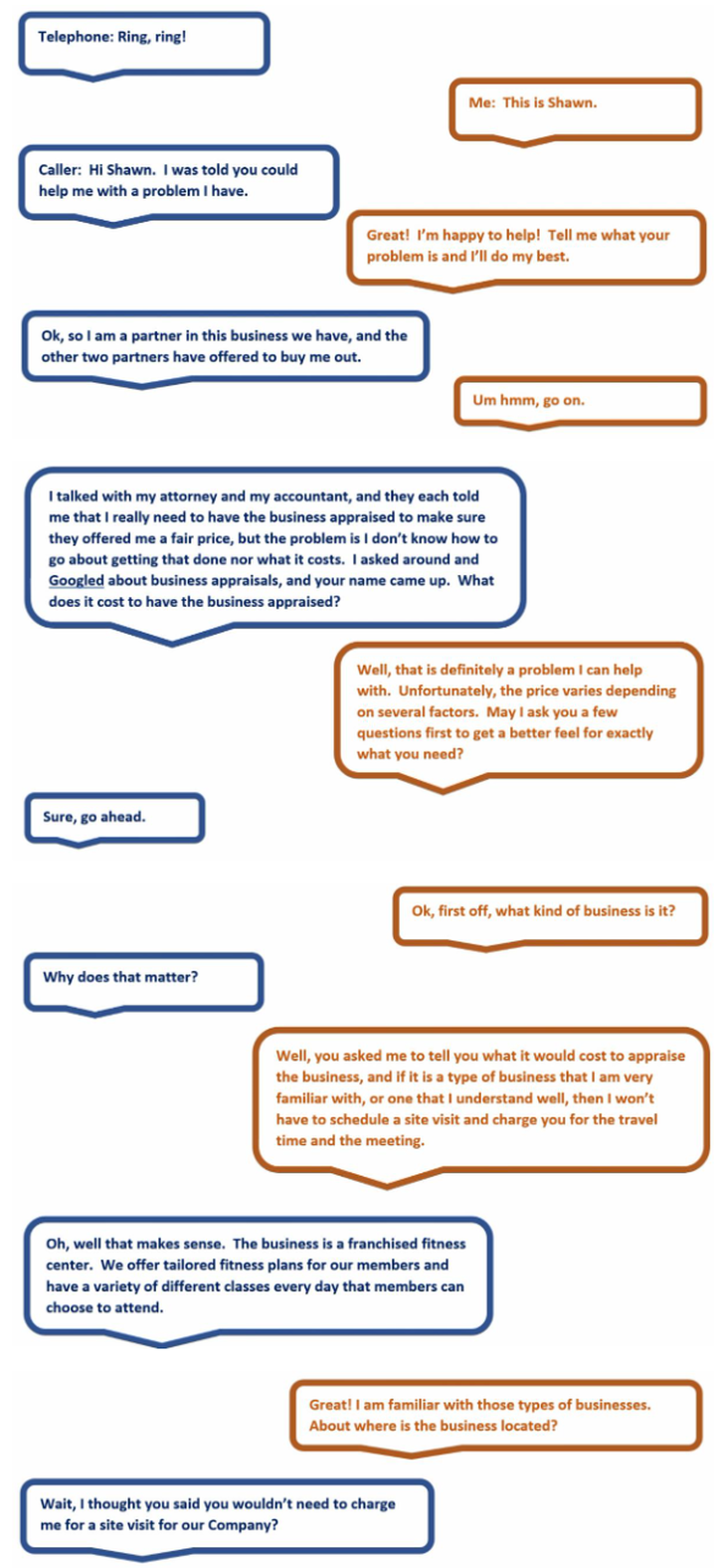

In today’s newsletter, I thought I’d write out and present a basic transcript of how that initial phone call tends to go, when a potential client picks up the phone and calls me. The following is a based on a call I had not too long ago, although I did take some artistic license and added a few things. I hope the conversation bubbles actually help you, my readers, keep track of the conversation, because it was a pain to put together. It starts with my phone ringing…

In today’s newsletter, I thought I’d write out and present a basic transcript of how that initial phone call tends to go, when a potential client picks up the phone and calls me. The following is a based on a call I had not too long ago, although I did take some artistic license and added a few things. I hope the conversation bubbles actually help you, my readers, keep track of the conversation, because it was a pain to put together. It starts with my phone ringing…

(Ok, adding all those images to the blog here, is going to be more difficult than I thought. Instead, if you are interested in reading the whole conversation, please click on the image and the newsletter I sent it out in will open up. You can read the whole thing there. Thanks!)

October 4, 2022 - Some Comments on Valuation Report Reviews

I review a lot of valuation reports. I may have mentioned that once or twice before. USPAP Standard number 3 talks about what should go into an appraisal review and Standard 4 covers what should be included in the review report, but I don’t typically get asked to go that route. Instead, I am often asked to read through a report and identify any areas where the appraiser may have mis-stepped with valuation theory or logic somewhere in the process of drawing their conclusions.

The point of most of the reviews I am paid to perform, is to help the appraiser to know where the weaknesses are in their report, and then to identify ways to shore up those analyses so their report is stronger when it is presented to their client.

As we all know, valuation is just as much an art as it is a science. That means that each appraiser’s opinion is just as valid as our own. Each appraiser may draw a different conclusion from their analysis of available data, sometimes the data that is available to one appraiser is not made available to another. In cases where I am reviewing another appraiser’s work, I need to keep in mind that appraisers may work differently than myself.

When reviewing a report for any sort of litigation issue, I prefer to focus on the big issues, where key assumptions make a large impact on the overall analysis. If I see typos or formatting issues, I may flag them, but those are not what I am looking for. (Unless the report was so poorly written that the errors get in the way of understanding the assumptions, then that does become a USPAP issue and I will need to point that out.)

One of my pet peeves is when I see an appraisal review where the reviewer went through and picked out every single misspelled word, typo, or formatting error, yet forgets to look at the assumptions and to consider how the report fits within basic valuation theory. I wonder if the reviewer in cases like this was an English major, instead of a valuation expert. Oftentimes, these reviews will also point out any method used that the reviewer is not familiar with and state that the appraiser who used it was ‘wrong’ to do so. How can a difference of opinion be ‘wrong’?

I had a case fairly recently, where the other appraiser managed to do almost everything exactly opposite to the way I performed my own valuation. I used the build-up method to develop my discount rate, the other appraiser used the Weighted Average Cost of Capital. I used the discounted future cash flow method and the other report used a capitalization of earnings model. I discussed the financial ratios in detail explaining where the subject company differed from the industry average, the other appraiser mentioned in passing the results of their financial analysis in the discussion of the risk rate.

I did find a few points where the underlying logic inherent in the appraiser’s assumptions caused the conclusion of value to differ significantly from mine, but it is important to note that I never once said that the other appraiser was wrong. In fact, during the comparison of my report with the other expert’s, I actually did find a math error, but it was in MY OWN REPORT. Once I corrected my error, the gap between our two numbers did widen some more, but neither of our conclusions of value were wrong, at least once I corrected my own error.

The key to providing a good review, is to be thorough, but to also be open minded. Consider what affect the assumptions made might have on the overall conclusion of value but don’t get mired down in minutiae that won’t matter in the long-term. If you have any questions you’d like to ask, give me a call sometime.

I review a lot of valuation reports. I may have mentioned that once or twice before. USPAP Standard number 3 talks about what should go into an appraisal review and Standard 4 covers what should be included in the review report, but I don’t typically get asked to go that route. Instead, I am often asked to read through a report and identify any areas where the appraiser may have mis-stepped with valuation theory or logic somewhere in the process of drawing their conclusions.

The point of most of the reviews I am paid to perform, is to help the appraiser to know where the weaknesses are in their report, and then to identify ways to shore up those analyses so their report is stronger when it is presented to their client.

As we all know, valuation is just as much an art as it is a science. That means that each appraiser’s opinion is just as valid as our own. Each appraiser may draw a different conclusion from their analysis of available data, sometimes the data that is available to one appraiser is not made available to another. In cases where I am reviewing another appraiser’s work, I need to keep in mind that appraisers may work differently than myself.

When reviewing a report for any sort of litigation issue, I prefer to focus on the big issues, where key assumptions make a large impact on the overall analysis. If I see typos or formatting issues, I may flag them, but those are not what I am looking for. (Unless the report was so poorly written that the errors get in the way of understanding the assumptions, then that does become a USPAP issue and I will need to point that out.)

One of my pet peeves is when I see an appraisal review where the reviewer went through and picked out every single misspelled word, typo, or formatting error, yet forgets to look at the assumptions and to consider how the report fits within basic valuation theory. I wonder if the reviewer in cases like this was an English major, instead of a valuation expert. Oftentimes, these reviews will also point out any method used that the reviewer is not familiar with and state that the appraiser who used it was ‘wrong’ to do so. How can a difference of opinion be ‘wrong’?

I had a case fairly recently, where the other appraiser managed to do almost everything exactly opposite to the way I performed my own valuation. I used the build-up method to develop my discount rate, the other appraiser used the Weighted Average Cost of Capital. I used the discounted future cash flow method and the other report used a capitalization of earnings model. I discussed the financial ratios in detail explaining where the subject company differed from the industry average, the other appraiser mentioned in passing the results of their financial analysis in the discussion of the risk rate.

I did find a few points where the underlying logic inherent in the appraiser’s assumptions caused the conclusion of value to differ significantly from mine, but it is important to note that I never once said that the other appraiser was wrong. In fact, during the comparison of my report with the other expert’s, I actually did find a math error, but it was in MY OWN REPORT. Once I corrected my error, the gap between our two numbers did widen some more, but neither of our conclusions of value were wrong, at least once I corrected my own error.

The key to providing a good review, is to be thorough, but to also be open minded. Consider what affect the assumptions made might have on the overall conclusion of value but don’t get mired down in minutiae that won’t matter in the long-term. If you have any questions you’d like to ask, give me a call sometime.

September 6, 2022 - What Documents Do We Ask For and Why?

One of my hobbies, ever since I was a small child able to hold my own books, has been reading. I really enjoy getting lost in a story told by an author who can weave images and characters in my mind with nothing more then a clever arrangement of letters on the page! I am one of those who will look up from a particularly good story only to realize that I wasn’t actually experiencing those events myself, that they were just images conjured up by a talented writer.

As a business appraiser, when we write up our valuation reports, we are in fact telling a story. Generally speaking, not as exciting a story as some of my favorite authors have written, but a story nonetheless. We are explaining how we arrived at our opinion of value, what factors we considered, what information we gathered, and what our conclusions were after analyzing it all. In order to begin an analysis, we typically ask for a certain selection of information from the client. This information will help us to either identify the future operating income, or the risk of achieving that income.

I like to ask for the last five years’ of tax returns and financial statements. Yes, I ask for both sets of documents for the same time periods. I ask for both sets, because often there is information on the tax returns that is not included in the more detailed balance sheets and income statements. I request the financials be provided to me on an accrual basis if possible, because I want to know what the business’ accounts receivable and payables would be as well as any bad debts they may have had. I will be analyzing historical results in order to help me predict the future. For startup businesses and those with a very brief history of operations, this analysis becomes much more abbreviated, but it is still important as it drives part of the risk analysis.

If the owner has family members on the payroll, that are actually attending school out of state, I want to see those W-2 forms so I can know the magnitude of that potential adjustment. Family members on the payroll who are actually not part of the operation is one of the adjustments that is easy to make and support, if we have the documentation to do so.

I generally don’t see detailed lists of equipment owned on the financial statements, so I tend to ask for a copy of their most recent depreciation schedule. That way I have a good collection of data, in case I need to place more weight on a method under the asset approach.

If there are contracts or leases in place with related parties, I want to see them as well. I’ll need to factor in potential adjustments to risk, as well as their impact on the earnings of the operation. Do they have a covenant not to compete with a partner who wants to be bought out? Do they have loans to or from shareholders that have a written and agreed upon payback schedule?

Sometimes the Company operating agreements will have language in them that limits or defines some of the adjustments that I can make. I need to know about those as part of the analysis.

Who owns the facility the business operates out of? If the building is owned by the company directly, or is held in a separate entity with similar ownership, or if the property is leased from a third party, I want to know. I’m asking for any prior appraisals of the business, the property, or anything else related to the assignment for any background information, and to see if there are any other factors that I need to consider.

If the business owners generate budgets or projections for the Company, I’d like to see the last five years’ of them so I can see how good management is at projecting their future results. If management tends to forecast really close to what their actual results are, then I would feel much better about incorporating their analyses for the future instead of relying on other sources.

I want a written history of the business. I want to know when the business started, who started it, what it used to do, and what the business does now. I want to know if the business has changed their focus before, if so, how it went and if the operation has plans to modify their operations going forward as well.

In addition to those documents, I am going to be researching the industry to see what trends are affecting businesses operating in similar fields. I’ll be looking at a comparative financial ratio analysis to see how the subject’s operations compare to the industry average. I will be looking at the economic situation and any particular risk drivers that will affect the business from that area as well.

All told, that is a significant amount of information to wade through. As I read and study and compare, I’m collecting information that explains why the business is operating as it does today. I’m looking for reasons that might explain how the future growth is expected to be achieved, and I’m looking for data that will support my conclusions as I write the report to explain how everything ties together and points me at the conclusion of value I arrived at.

I’ll be writing my report, which is the story of my analysis, explaining what I examined, and how it affected my overall conclusions, and what data I relied on to draw those conclusions. Occasionally, I’ll get a call from a client asking me to appraise a business, but when they see the sheer quantity of data I ask for, they will change their mind, or only give me a small part of what I requested. When that happens, I may have to rely more on approximations and generalities in my assumptions which will lead to my delivering a range of values instead of single number.

When I think about everything that goes into a business appraisal, all the mental effort, thought, logic exercises and sheer quantity of material I have to run through, one thought keeps coming to my mind.

It’s been a very good thing that I like to read!

One of my hobbies, ever since I was a small child able to hold my own books, has been reading. I really enjoy getting lost in a story told by an author who can weave images and characters in my mind with nothing more then a clever arrangement of letters on the page! I am one of those who will look up from a particularly good story only to realize that I wasn’t actually experiencing those events myself, that they were just images conjured up by a talented writer.

As a business appraiser, when we write up our valuation reports, we are in fact telling a story. Generally speaking, not as exciting a story as some of my favorite authors have written, but a story nonetheless. We are explaining how we arrived at our opinion of value, what factors we considered, what information we gathered, and what our conclusions were after analyzing it all. In order to begin an analysis, we typically ask for a certain selection of information from the client. This information will help us to either identify the future operating income, or the risk of achieving that income.

I like to ask for the last five years’ of tax returns and financial statements. Yes, I ask for both sets of documents for the same time periods. I ask for both sets, because often there is information on the tax returns that is not included in the more detailed balance sheets and income statements. I request the financials be provided to me on an accrual basis if possible, because I want to know what the business’ accounts receivable and payables would be as well as any bad debts they may have had. I will be analyzing historical results in order to help me predict the future. For startup businesses and those with a very brief history of operations, this analysis becomes much more abbreviated, but it is still important as it drives part of the risk analysis.

If the owner has family members on the payroll, that are actually attending school out of state, I want to see those W-2 forms so I can know the magnitude of that potential adjustment. Family members on the payroll who are actually not part of the operation is one of the adjustments that is easy to make and support, if we have the documentation to do so.

I generally don’t see detailed lists of equipment owned on the financial statements, so I tend to ask for a copy of their most recent depreciation schedule. That way I have a good collection of data, in case I need to place more weight on a method under the asset approach.

If there are contracts or leases in place with related parties, I want to see them as well. I’ll need to factor in potential adjustments to risk, as well as their impact on the earnings of the operation. Do they have a covenant not to compete with a partner who wants to be bought out? Do they have loans to or from shareholders that have a written and agreed upon payback schedule?

Sometimes the Company operating agreements will have language in them that limits or defines some of the adjustments that I can make. I need to know about those as part of the analysis.

Who owns the facility the business operates out of? If the building is owned by the company directly, or is held in a separate entity with similar ownership, or if the property is leased from a third party, I want to know. I’m asking for any prior appraisals of the business, the property, or anything else related to the assignment for any background information, and to see if there are any other factors that I need to consider.

If the business owners generate budgets or projections for the Company, I’d like to see the last five years’ of them so I can see how good management is at projecting their future results. If management tends to forecast really close to what their actual results are, then I would feel much better about incorporating their analyses for the future instead of relying on other sources.

I want a written history of the business. I want to know when the business started, who started it, what it used to do, and what the business does now. I want to know if the business has changed their focus before, if so, how it went and if the operation has plans to modify their operations going forward as well.

In addition to those documents, I am going to be researching the industry to see what trends are affecting businesses operating in similar fields. I’ll be looking at a comparative financial ratio analysis to see how the subject’s operations compare to the industry average. I will be looking at the economic situation and any particular risk drivers that will affect the business from that area as well.

All told, that is a significant amount of information to wade through. As I read and study and compare, I’m collecting information that explains why the business is operating as it does today. I’m looking for reasons that might explain how the future growth is expected to be achieved, and I’m looking for data that will support my conclusions as I write the report to explain how everything ties together and points me at the conclusion of value I arrived at.

I’ll be writing my report, which is the story of my analysis, explaining what I examined, and how it affected my overall conclusions, and what data I relied on to draw those conclusions. Occasionally, I’ll get a call from a client asking me to appraise a business, but when they see the sheer quantity of data I ask for, they will change their mind, or only give me a small part of what I requested. When that happens, I may have to rely more on approximations and generalities in my assumptions which will lead to my delivering a range of values instead of single number.

When I think about everything that goes into a business appraisal, all the mental effort, thought, logic exercises and sheer quantity of material I have to run through, one thought keeps coming to my mind.

It’s been a very good thing that I like to read!

August 2, 2022 - Why Use an Average Multiple?

I remember when I learned about averages, summing a collection of numbers and then dividing by how many there were in order to determine the average of the collection of data. That was an eye opening lesson. Then, later on I was taught about medians, modes, and the whole concept of central tendency and the impact outliers have on a statistical analysis! I was probably one of the few kids in that middle school math class who actually found all of that very interesting, and now that I use that knowledge everyday in my valuation practice, I have found that I am even more animated by them, but not in the way you might expect.

One of my biggest pet peeves about the valuation industry, is how prevalent the use of an average or a median is when selecting a risk rate, market multiple, or in any other type of analysis. Each time I review a report for another appraiser, and I see an average or a median market multiple selected, I like to ask the question, “So, is the subject business you are appraising an average or a median business?”

Very often an appraiser will analyze a collection of market datapoints, transactions of other similar businesses that have been reported to one of the various databases business appraisers and brokers have access to, and decide to select an average or median price to revenues or price to seller’s discretionary earnings multiple for use in their valuation report. Often, there will be a few outliers that were too low, or too high for the analyst’s comfort level and those were removed, but there will be no reason for why they were removed other than they were outside the selected range.

WHY WERE THEY OUTSIDE THE SELECTED RANGE??

What parameters did the analyst place on the data to arrive at the selected range? Usually, there will be a revenues range filter applied, which means that the analyst will remove from consideration those businesses that were either much larger or much smaller than the subject. That is a good start, but within the remaining data, there may often be individual transactions that sold for much more or much less than the others, but for specific reasons.

Sometimes, a broker might sell the real estate in addition to the business. Sometimes a seller might accept a lower price due to their particular motivations. Occasionally, a business might sell for much more than others because it was acquired by a publicly traded business. These are reasons why specific datapoints may need to be removed from an analysis, but it doesn’t seem very scientific to throw away data simply because it doesn’t meet one’s preconceived notions. Granted, we typically don’t have access to a lot of data for each individual transaction, so we often need to exercise our professional judgment when making determinations about specific transactions.

As business appraisers we are most often asked to develop our opinion of the fair market value of the subject business, and as part of our analysis we look at the market approach to help derive that answer.

What we need to keep in mind however, is that not a single one of those transactions we are looking at, was ever consummated at the standard of value of fair market value.

Each transaction was the result of two parties, each of whom had some form of compulsion to buy or sell, at least one of which may or may not have had reasonable knowledge of all relevant facts, and most importantly, both parties were NOT hypothetical. See the differences between the standard of value these transactions were sold at and the definition of fair market value?

We analyze these transactions because they exist and the market approach and valuation standards say we should include this analysis when appropriate, but the selection of the final multiple to apply in our valuation method is completely up to the appraiser. I look at the financial ratio comparative analysis which shows me if the subject business is weaker or stronger than the industry average. I gauge this overall strength or weakness by the quantity of the ratios that show the business is weaker or stronger than the average business in the subject industry. Then I adjust my average or median multiple accordingly, up or down, in order to derive my opinion of the value of the subject business.

As professional business appraisers and analysts, we are tasked to share our opinion of the value of a business. It only makes sense to me that in order to do so, we step a little further along the path of analysis than were taught back in elementary school. We don’t have a source or chart to refer to for the magnitude of the adjustments we might make to an average or median multiple, but that is why we have professional judgment. In our opinion, based on our training, education and experience, the selected market multiple may very well NOT be simply an average or a median multiple. I look forward to reading the explanation of why those adjustments were made in your reports!

As always, I am happy to chat if you have a question or would like some help on a particular valuation project.

I remember when I learned about averages, summing a collection of numbers and then dividing by how many there were in order to determine the average of the collection of data. That was an eye opening lesson. Then, later on I was taught about medians, modes, and the whole concept of central tendency and the impact outliers have on a statistical analysis! I was probably one of the few kids in that middle school math class who actually found all of that very interesting, and now that I use that knowledge everyday in my valuation practice, I have found that I am even more animated by them, but not in the way you might expect.

One of my biggest pet peeves about the valuation industry, is how prevalent the use of an average or a median is when selecting a risk rate, market multiple, or in any other type of analysis. Each time I review a report for another appraiser, and I see an average or a median market multiple selected, I like to ask the question, “So, is the subject business you are appraising an average or a median business?”

Very often an appraiser will analyze a collection of market datapoints, transactions of other similar businesses that have been reported to one of the various databases business appraisers and brokers have access to, and decide to select an average or median price to revenues or price to seller’s discretionary earnings multiple for use in their valuation report. Often, there will be a few outliers that were too low, or too high for the analyst’s comfort level and those were removed, but there will be no reason for why they were removed other than they were outside the selected range.

WHY WERE THEY OUTSIDE THE SELECTED RANGE??

What parameters did the analyst place on the data to arrive at the selected range? Usually, there will be a revenues range filter applied, which means that the analyst will remove from consideration those businesses that were either much larger or much smaller than the subject. That is a good start, but within the remaining data, there may often be individual transactions that sold for much more or much less than the others, but for specific reasons.

Sometimes, a broker might sell the real estate in addition to the business. Sometimes a seller might accept a lower price due to their particular motivations. Occasionally, a business might sell for much more than others because it was acquired by a publicly traded business. These are reasons why specific datapoints may need to be removed from an analysis, but it doesn’t seem very scientific to throw away data simply because it doesn’t meet one’s preconceived notions. Granted, we typically don’t have access to a lot of data for each individual transaction, so we often need to exercise our professional judgment when making determinations about specific transactions.

As business appraisers we are most often asked to develop our opinion of the fair market value of the subject business, and as part of our analysis we look at the market approach to help derive that answer.

What we need to keep in mind however, is that not a single one of those transactions we are looking at, was ever consummated at the standard of value of fair market value.

Each transaction was the result of two parties, each of whom had some form of compulsion to buy or sell, at least one of which may or may not have had reasonable knowledge of all relevant facts, and most importantly, both parties were NOT hypothetical. See the differences between the standard of value these transactions were sold at and the definition of fair market value?

We analyze these transactions because they exist and the market approach and valuation standards say we should include this analysis when appropriate, but the selection of the final multiple to apply in our valuation method is completely up to the appraiser. I look at the financial ratio comparative analysis which shows me if the subject business is weaker or stronger than the industry average. I gauge this overall strength or weakness by the quantity of the ratios that show the business is weaker or stronger than the average business in the subject industry. Then I adjust my average or median multiple accordingly, up or down, in order to derive my opinion of the value of the subject business.

As professional business appraisers and analysts, we are tasked to share our opinion of the value of a business. It only makes sense to me that in order to do so, we step a little further along the path of analysis than were taught back in elementary school. We don’t have a source or chart to refer to for the magnitude of the adjustments we might make to an average or median multiple, but that is why we have professional judgment. In our opinion, based on our training, education and experience, the selected market multiple may very well NOT be simply an average or a median multiple. I look forward to reading the explanation of why those adjustments were made in your reports!

As always, I am happy to chat if you have a question or would like some help on a particular valuation project.

July 19, 2022 - What is Actually Being Appraised?

This is a very important question! When I receive a request to appraise a business, one of the first things I attempt to find out, is what aspect of that business exactly, am I being asked to appraise?

There are several different business valuation assignments that I could be asked to complete for any specific business, and each will arrive at a different answer, so you can see why I would need to figure this part out rather quickly.

I could be asked to appraise a controlling equity ownership in the company stock, member units, depending on how the entity is organized. I could be asked to appraise a non-controlling equity ownership interest, or I could be asked to appraise what many business brokers refer to as the “Most Probable Selling Price” (MPSP). I tend to refer to these projects as an appraisal of the “Assets That Typically Transfer in a Sale”.

Each one of those options includes different underlying assumptions, assuming each is governed by the standard of value of Fair Market Value. (If another standard of value needs to be used, then many of the following assumptions are modified again.)

If I am appraising a controlling equity interest, I am going to be looking for discretionary expenses to add back, I am going to be looking for non-operating assets and/or liabilities to adjust out, and I am going to be working this appraisal from the perspective of a potential buyer buying into the scenario as presented with all the assets and liabilities held by the business being considered.

If I am appraising a non-controlling equity ownership interest, I am not necessarily going to be adjusting out discretionary expenses, I may still be looking for non-operating assets and liabilities, but as a non-controlling equity interest holder cannot decide to sell of those assets, I am also not going to be adjusting them out. I am working this appraisal scenario from the perspective of an investor considering the risk of buying into a partnership where distributions to non-controlling shareholders are reduced by the need to fund non-operating assets. I will also be including discounts for lack of control and marketability, IF I am using the fair market value standard of value.

If I am appraising only those assets that typically transfer in a sale, or MPSP, certain adjustments need to be made to many of the methods used. (However, sometimes a buyer will request to purchase some working capital, and that request could throw another wrinkle into the appraisal. Most of the time, that adjustment can be handled by adding a dollar for dollar increase to the appraised value for the requested working capital. Most of the time.)

Let’s look at some of the modifications an appraiser must make to application of commonly used valuation methods in order to deliver an analysis of the MPSP.

Any use of the adjusted book value method considering the tangible assets held by the business will need to have cash, and accounts receivable excluded, and the liabilities removed as a buyer in this scenario will not be taking possession of any of those.

Depending on what income stream is selected to run the capitalization of earnings or the discounted cash flow methods, the analyst will have to select a risk rate that matches it, but the most commonly taught income stream is net cash flow, and the most commonly selected rate comes from the build-up method, which means that the indication of value will include an operating level of cash, accounts receivable and the associated amounts of working liabilities. Depending on if the analysis used net cash flow to equity or net cash flow to invested capital, the indication of value may or may not include the effects of the long-term liabilities held. In order to adjust the indication of value to get a MPSP, an operating level of cash must be removed, (If the business holds excess cash, watch out for double counting by removing the excess again at this step.) accounts receivable need to be removed and again, depending on what version of net cash flow was used, liabilities need to be dealt with.

The excess earnings method can derive an equity value or an MPSP value, depending on how the selected income stream was calculated, and if equity or assets were used to calculate the return on tangible assets rate.

Methods under the market approach, if using data from the databases of privately held businesses, typically arrive at an indication of value of the Most Probable Selling Price (MPSP) for an asset sale right out of the gate, but depending on the database used, the analysis may or may not include transactions that were sold as stock deals. When a business appraiser reports a transaction as being sold as a stock deal, it is generally unknown if that transaction included a level of working capital, or if the transaction was structured that way solely for tax purposes, and the buyer did not actually acquire any AR or assume any debt making it more of a modified stock deal. Typically, the transactions reported as asset sales were structured as MPSP deals, but watch out for those transactions where the broker also sold the associated real estate, which would skew the analyzed multiples upwards based on the value of the real property included in that sales price.

I recently had a request to appraise her business from a potential client. As I went through my normal questions to see what purpose she needed the appraisal for, and to make sure I knew which of the various scenarios described above was needed, she asked me a very interesting question. “Why did I need to know all this information?”

Apparently, she had just been on several websites and received several “valuations” for her business already, and she did not realize that those numbers she had received, were likely for a MPSP scenario, but she was considering selling to an Employee Stock Ownership Plan (ESOP). Quick question to all of the business brokers and advisors reading this:

When you provide your analysis to determine a likely selling price for a business, how confident are you that your same analysis could also be used to fund an ESOP sale?

Most likely, not very confident, as an ESOP valuation requires an entirely different set of assumptions, even beyond what we include when appraising an equity interest.

That first phone call is key, and finding out what we are being asked to appraise and why is also extremely important. Not only for our peace of mind, but also to determine what we are going to charge for the project. An analysis for a MPSP, is likely a lot cheaper than running a report for review by the US Department of Labor.

This is a very important question! When I receive a request to appraise a business, one of the first things I attempt to find out, is what aspect of that business exactly, am I being asked to appraise?

There are several different business valuation assignments that I could be asked to complete for any specific business, and each will arrive at a different answer, so you can see why I would need to figure this part out rather quickly.

I could be asked to appraise a controlling equity ownership in the company stock, member units, depending on how the entity is organized. I could be asked to appraise a non-controlling equity ownership interest, or I could be asked to appraise what many business brokers refer to as the “Most Probable Selling Price” (MPSP). I tend to refer to these projects as an appraisal of the “Assets That Typically Transfer in a Sale”.

Each one of those options includes different underlying assumptions, assuming each is governed by the standard of value of Fair Market Value. (If another standard of value needs to be used, then many of the following assumptions are modified again.)

If I am appraising a controlling equity interest, I am going to be looking for discretionary expenses to add back, I am going to be looking for non-operating assets and/or liabilities to adjust out, and I am going to be working this appraisal from the perspective of a potential buyer buying into the scenario as presented with all the assets and liabilities held by the business being considered.

If I am appraising a non-controlling equity ownership interest, I am not necessarily going to be adjusting out discretionary expenses, I may still be looking for non-operating assets and liabilities, but as a non-controlling equity interest holder cannot decide to sell of those assets, I am also not going to be adjusting them out. I am working this appraisal scenario from the perspective of an investor considering the risk of buying into a partnership where distributions to non-controlling shareholders are reduced by the need to fund non-operating assets. I will also be including discounts for lack of control and marketability, IF I am using the fair market value standard of value.

If I am appraising only those assets that typically transfer in a sale, or MPSP, certain adjustments need to be made to many of the methods used. (However, sometimes a buyer will request to purchase some working capital, and that request could throw another wrinkle into the appraisal. Most of the time, that adjustment can be handled by adding a dollar for dollar increase to the appraised value for the requested working capital. Most of the time.)

Let’s look at some of the modifications an appraiser must make to application of commonly used valuation methods in order to deliver an analysis of the MPSP.

Any use of the adjusted book value method considering the tangible assets held by the business will need to have cash, and accounts receivable excluded, and the liabilities removed as a buyer in this scenario will not be taking possession of any of those.

Depending on what income stream is selected to run the capitalization of earnings or the discounted cash flow methods, the analyst will have to select a risk rate that matches it, but the most commonly taught income stream is net cash flow, and the most commonly selected rate comes from the build-up method, which means that the indication of value will include an operating level of cash, accounts receivable and the associated amounts of working liabilities. Depending on if the analysis used net cash flow to equity or net cash flow to invested capital, the indication of value may or may not include the effects of the long-term liabilities held. In order to adjust the indication of value to get a MPSP, an operating level of cash must be removed, (If the business holds excess cash, watch out for double counting by removing the excess again at this step.) accounts receivable need to be removed and again, depending on what version of net cash flow was used, liabilities need to be dealt with.

The excess earnings method can derive an equity value or an MPSP value, depending on how the selected income stream was calculated, and if equity or assets were used to calculate the return on tangible assets rate.

Methods under the market approach, if using data from the databases of privately held businesses, typically arrive at an indication of value of the Most Probable Selling Price (MPSP) for an asset sale right out of the gate, but depending on the database used, the analysis may or may not include transactions that were sold as stock deals. When a business appraiser reports a transaction as being sold as a stock deal, it is generally unknown if that transaction included a level of working capital, or if the transaction was structured that way solely for tax purposes, and the buyer did not actually acquire any AR or assume any debt making it more of a modified stock deal. Typically, the transactions reported as asset sales were structured as MPSP deals, but watch out for those transactions where the broker also sold the associated real estate, which would skew the analyzed multiples upwards based on the value of the real property included in that sales price.

I recently had a request to appraise her business from a potential client. As I went through my normal questions to see what purpose she needed the appraisal for, and to make sure I knew which of the various scenarios described above was needed, she asked me a very interesting question. “Why did I need to know all this information?”

Apparently, she had just been on several websites and received several “valuations” for her business already, and she did not realize that those numbers she had received, were likely for a MPSP scenario, but she was considering selling to an Employee Stock Ownership Plan (ESOP). Quick question to all of the business brokers and advisors reading this:

When you provide your analysis to determine a likely selling price for a business, how confident are you that your same analysis could also be used to fund an ESOP sale?

Most likely, not very confident, as an ESOP valuation requires an entirely different set of assumptions, even beyond what we include when appraising an equity interest.

That first phone call is key, and finding out what we are being asked to appraise and why is also extremely important. Not only for our peace of mind, but also to determine what we are going to charge for the project. An analysis for a MPSP, is likely a lot cheaper than running a report for review by the US Department of Labor.

July 5, 2022 - Rules of Thumb are Useful Tools, But...

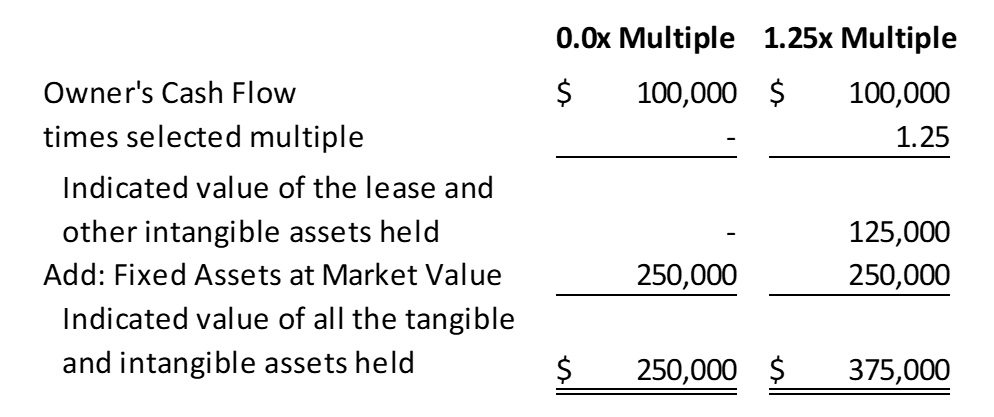

Rules of thumb have been around almost as long as there have been thumbs. People enjoy using a measurement that is always at hand, as it were, without having to do a lot of complicated research and analysis. Unfortunately, there is no standard thumb size so each measurement performed by each individual with their own thumb will be different than any other’s measurement of the same thing. That sort of confusion has spawned a multitude of different rules of thumb that different experts have formulated to help themselves perform various measurements. One example would be a measurement of the length of a specific piece of wood. Depending on the size of the individual, a rule of thumb of “three handspans in length” might be equal to another’s “4.5 handspans in length”. It doesn’t mean that the length of that board changed, it just means that one individual has smaller hands than the other. The next set of carpenters to come by and measure that same piece of wood, remembering the easy rules of thumb mentioned by those before, will be expecting to see a length of wood of between 3 and 4.5 times the width of their hands, but it will actually be a slightly different multiple of handspans for each carpenter.

When it comes to business valuation, pricing a business for sale, or simply checking to see what it might cost to buy out a partner, rules of thumb are an easy option; but there are so many variables affecting that answer, that the best answer one can get with a series of rules of thumb is really a range of values, and that range will be different for each thumb used to measure it. Not to mention that rules of thumb are also always changed and growing over time as market conditions and businesses evolve.

Let’s explore that concept about rules of thumb changing over time. I own a copy of a book first published in 1987, but my copy is the third edition and was published in 1993. It is the Handbook of Small Business Valuation Formulas and Rules of Thumb by Glenn Desmond, published by Valuation Press. In it there is a rule of thumb for Automobile Dealerships that says the following:

Use a stabilized Owner’s Cash Flow (OCF).

OCF multiplier typical range: 0.0x – 1.25x OCF

Formula assets included in the indicated value:

Add fixed assets at market value to formula assets.

Please note that the above ‘rule’ can be summarized by saying, “Apply a multiple to earnings, then add fixed assets.” What also needs to be pointed out is that the multiple range varies from zero to 1.25 times, and the selected multiple depends on a variety of other factors described in the book, such as the type of dealership, trends in the national economy, the location of the facility and the terms of the lease. Let’s use the following simplified sample data for pricing an auto dealership owned back in the early 1990s:

(Please note that most rules of thumb for business pricing like this one, do NOT include the value of any real property the owner may actually have.)

The range of indicated pricing for our hypothetical 1990s auto dealership is shown below:

Rules of thumb have been around almost as long as there have been thumbs. People enjoy using a measurement that is always at hand, as it were, without having to do a lot of complicated research and analysis. Unfortunately, there is no standard thumb size so each measurement performed by each individual with their own thumb will be different than any other’s measurement of the same thing. That sort of confusion has spawned a multitude of different rules of thumb that different experts have formulated to help themselves perform various measurements. One example would be a measurement of the length of a specific piece of wood. Depending on the size of the individual, a rule of thumb of “three handspans in length” might be equal to another’s “4.5 handspans in length”. It doesn’t mean that the length of that board changed, it just means that one individual has smaller hands than the other. The next set of carpenters to come by and measure that same piece of wood, remembering the easy rules of thumb mentioned by those before, will be expecting to see a length of wood of between 3 and 4.5 times the width of their hands, but it will actually be a slightly different multiple of handspans for each carpenter.

When it comes to business valuation, pricing a business for sale, or simply checking to see what it might cost to buy out a partner, rules of thumb are an easy option; but there are so many variables affecting that answer, that the best answer one can get with a series of rules of thumb is really a range of values, and that range will be different for each thumb used to measure it. Not to mention that rules of thumb are also always changed and growing over time as market conditions and businesses evolve.

Let’s explore that concept about rules of thumb changing over time. I own a copy of a book first published in 1987, but my copy is the third edition and was published in 1993. It is the Handbook of Small Business Valuation Formulas and Rules of Thumb by Glenn Desmond, published by Valuation Press. In it there is a rule of thumb for Automobile Dealerships that says the following:

Use a stabilized Owner’s Cash Flow (OCF).

OCF multiplier typical range: 0.0x – 1.25x OCF

Formula assets included in the indicated value:

- Lease

- Intangibles

Add fixed assets at market value to formula assets.

Please note that the above ‘rule’ can be summarized by saying, “Apply a multiple to earnings, then add fixed assets.” What also needs to be pointed out is that the multiple range varies from zero to 1.25 times, and the selected multiple depends on a variety of other factors described in the book, such as the type of dealership, trends in the national economy, the location of the facility and the terms of the lease. Let’s use the following simplified sample data for pricing an auto dealership owned back in the early 1990s:

- Owner’s Cash Flow - $100,000

- Fixed Assets at Market Value - $250,000

- Annual Sales - $1,000,000

(Please note that most rules of thumb for business pricing like this one, do NOT include the value of any real property the owner may actually have.)

The range of indicated pricing for our hypothetical 1990s auto dealership is shown below:

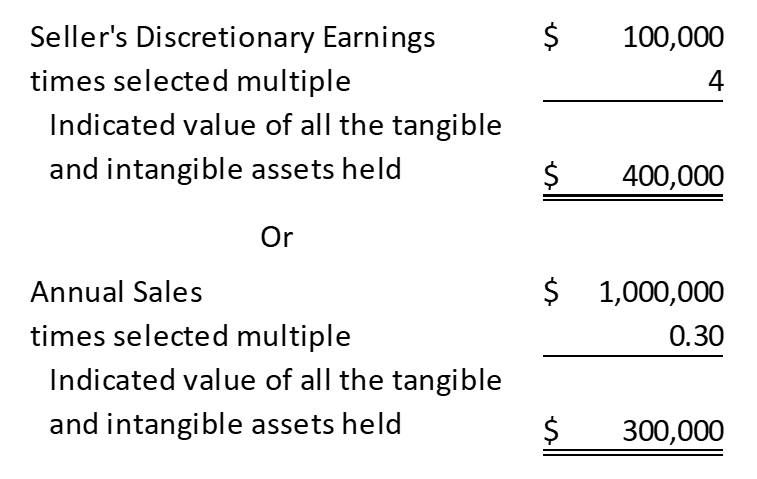

I am going to compare that rule of thumb, to those described in the current version (2022) of the Business Reference Guide, published by Business Brokerage Press and compiled by Tom West for Auto Dealerships – New Cars that shows two completely different rules of thumb. The new terminology of ‘Seller’s Discretionary Earnings’, is equivalent to the older style phrasing of ‘Owner’s Cash Flow’, so I am going to use those same sample numbers described above.

4 x Seller’s Discretionary Earnings (SDE)

Or

30% of Annual Sale

4 x Seller’s Discretionary Earnings (SDE)

Or

30% of Annual Sale

Please note, these modern multiples do not add back the market value of any fixed assets the business owns, because the value of those items required by the operations, are included in the use of the selected (larger) multiple. Just like the book I cited above published in 1993, if one reads further, there are directions explaining what factors need to be analyzed that will affect the size of the selected multiple used by the rules of thumb. The overall price of a specific business will depend on the market value of the operating inventory, the furniture, fixtures, and equipment, and other factors. That means an analysis of the subject dealership could indicate that the selected SDE multiple should be smaller or larger than 4, and a similar adjustment may be appropriate for a revenue multiplier.

(It also means that if the subject business owns certain assets that are not necessary for operations, those assets are not included in the indication of value determined.)

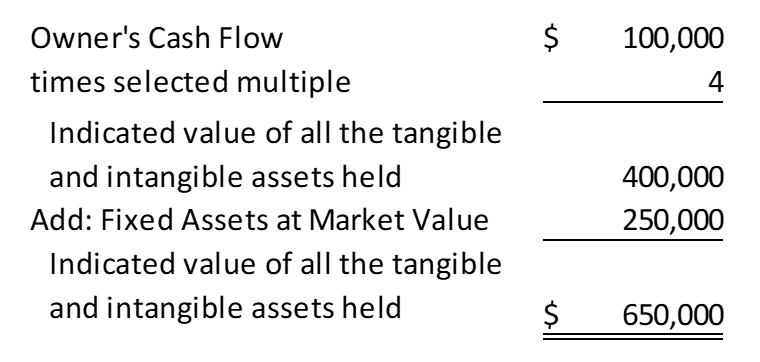

One of the most significant challenges we all face as professionals determining a value for a business, regardless of the purpose requiring that valuation, is to make sure that we are always using the correct variables for whatever formula we are attempting to use. Imagine what would happen to an expert who conflated several rules of thumb, and used parts from one and parts from another and combined them to make up their own rule of thumb, without ever having actually personally measured that one board the original rules of thumb were based on? An example is illustrated below:

(It also means that if the subject business owns certain assets that are not necessary for operations, those assets are not included in the indication of value determined.)

One of the most significant challenges we all face as professionals determining a value for a business, regardless of the purpose requiring that valuation, is to make sure that we are always using the correct variables for whatever formula we are attempting to use. Imagine what would happen to an expert who conflated several rules of thumb, and used parts from one and parts from another and combined them to make up their own rule of thumb, without ever having actually personally measured that one board the original rules of thumb were based on? An example is illustrated below:

The above example is double counting the value of the fixed assets held by the business. The selected multiple of 4x, includes the assets that are required by the operation to generate those cash flows. If the business did not have those assets, then it would also not have that level of earnings. A conflated rule of thumb will typically return an inflated value, as most people tend to pick and choose the larger variables from any ‘rule of thumb’ they happen to remember having read once upon a time.

Just because the math works in the example above, doesn’t mean a deal will close under those terms. Remember that length of wood we talked about at first? Using this conflated example, a professional is basically attempting to sell a 32-inch board by telling interested parties that it is actually 48 inches long. As soon as one of those interested parties brings out their own tape measure and runs through their own due diligence, they will know that the board’s length had been grossly overestimated. Logic, reasonableness, and basic valuation theory must be a part of the process, or the numbers that we end up determining for the Companies we service, simply won’t be realistic.

Just because the math works in the example above, doesn’t mean a deal will close under those terms. Remember that length of wood we talked about at first? Using this conflated example, a professional is basically attempting to sell a 32-inch board by telling interested parties that it is actually 48 inches long. As soon as one of those interested parties brings out their own tape measure and runs through their own due diligence, they will know that the board’s length had been grossly overestimated. Logic, reasonableness, and basic valuation theory must be a part of the process, or the numbers that we end up determining for the Companies we service, simply won’t be realistic.

June 24, 2022 - Business Valuation Basics

When a client asks you if you can appraise a specific business, there are always questions we ask to make sure that we can in fact accomplish that task.

“What kind of businesses is it? What type of financial statements will I have access to? What is the purpose of the assignment? When do I need to have the report done by?”

All of those a very good questions and their answers allows us to manage client expectations or decide if another appraiser might work better for that client.

Once we accept an assignment, and we have received the financial data we requested, there are a few steps that we all go through.

2. We analyze the operational risk of the company

This can be done via a comparative financial ratio analysis, where we check to see if the operational characteristics of the business are stronger, weaker, or about the same as the industry average. Some appraisers prefer to use a Strengths, Weaknesses, Opportunities, Threats (SWOT) analysis, or some other such comparative analysis, but we are all measuring risk, because income divided by risk equals value.

3. We predict the future

This is the step that catches certain appraisers off guard. “But I am using a weighted average of historical earnings, I’m not forecasting anything.” Actually, you are. If you are using that technique, you are still predicting the future, you are just predicting the future to look somewhat similar to historical results. If your weighted average shows a lower expected income because the business has been growing over the past five years, perhaps the future will not look exactly like operations did three years ago. Revenue Ruling 59-60 talks about how valuation is a prophecy as to the future, and we are expected to look forward, basing our choices on data that was knowable as of the effective date.

4. We select and calculate applicable methods

This is another area I see certain appraisers run into trouble with. Not every method is applicable to every assignment. If your report always includes the same twelve methods, and your value conclusion is some average of all of them, I am going to suggest that you may need to rethink your overall approach. Each method has a wide degree of flexibility to it, as each method relies on an appraiser’s judgment and experience to calculate the number. If your various indications of value are all over the board, that simply shows that you are lacking in control over your own appraisal. What assumptions are you making without even knowing about them? Each method includes a variety of assumptions based on usage and/or underlaying data, and it is an appraiser’s job to harness those and to make sure that each method is pointing in at least the same direction. Are your assumptions for one method arriving at a stock value, while others are determining the value of the Company’s assets? If one method measures a company’s equity value, yet another is looking at its invested capital, it is your job to both know that and adjust for it.

5. We conclude to a final value

Each indication of value from each method used, will provide a slightly different indication of value. That is normal and expected. Some methods ae simply more appropriate for certain types of projects than others. Some methods require significant adjustments to make them provide an accurate indication of value, and sometimes our underlying data is simply not as accurate as we would like it to be which will skew the results. In those cases, we need to exercise our judgement and explain how and why certain methods are less applicable and why we chose to either ignore, or place significantly less weight on certain of them.

6. We write our report

The communication of our reasonings and how we approached the appraisal problem, is just as much, if not more important then the actual numbers we used. Not only are our clients going to be looking for reasons why the concluded value is lower than they expected, so may our clients’ bankers, lawyers, spouse’s appraisal experts, potential buyers, and the occasional brother-in-law. If our reports do not clearly outline how we applied basic valuation theory, we may end up spending even more unpaid time answering questions that a little forethought on our part could have handled. (I do enjoy answering certain questions by telling the questioner what page of the report answers that particular question.)

Overall, valuation is fairly simple industry. We collect data, analyze it, draw conclusions, and then communicate our findings. Even those first few questions we ask our potential client about deadlines and appraisal purposes are gathering data so we can analyze and draw our conclusion of if we want that project or not. The basics are easy, but occasionally the details can become complicated.

If you have any questions you’d like to bounce off of a third-party, you can reach me at [email protected].

Your friendly neighborhood business appraiser,

Shawn Hyde, CBA, CVA, CMEA, BCA

When a client asks you if you can appraise a specific business, there are always questions we ask to make sure that we can in fact accomplish that task.

“What kind of businesses is it? What type of financial statements will I have access to? What is the purpose of the assignment? When do I need to have the report done by?”

All of those a very good questions and their answers allows us to manage client expectations or decide if another appraiser might work better for that client.

Once we accept an assignment, and we have received the financial data we requested, there are a few steps that we all go through.

- We analyze historical results

2. We analyze the operational risk of the company

This can be done via a comparative financial ratio analysis, where we check to see if the operational characteristics of the business are stronger, weaker, or about the same as the industry average. Some appraisers prefer to use a Strengths, Weaknesses, Opportunities, Threats (SWOT) analysis, or some other such comparative analysis, but we are all measuring risk, because income divided by risk equals value.

3. We predict the future

This is the step that catches certain appraisers off guard. “But I am using a weighted average of historical earnings, I’m not forecasting anything.” Actually, you are. If you are using that technique, you are still predicting the future, you are just predicting the future to look somewhat similar to historical results. If your weighted average shows a lower expected income because the business has been growing over the past five years, perhaps the future will not look exactly like operations did three years ago. Revenue Ruling 59-60 talks about how valuation is a prophecy as to the future, and we are expected to look forward, basing our choices on data that was knowable as of the effective date.

4. We select and calculate applicable methods

This is another area I see certain appraisers run into trouble with. Not every method is applicable to every assignment. If your report always includes the same twelve methods, and your value conclusion is some average of all of them, I am going to suggest that you may need to rethink your overall approach. Each method has a wide degree of flexibility to it, as each method relies on an appraiser’s judgment and experience to calculate the number. If your various indications of value are all over the board, that simply shows that you are lacking in control over your own appraisal. What assumptions are you making without even knowing about them? Each method includes a variety of assumptions based on usage and/or underlaying data, and it is an appraiser’s job to harness those and to make sure that each method is pointing in at least the same direction. Are your assumptions for one method arriving at a stock value, while others are determining the value of the Company’s assets? If one method measures a company’s equity value, yet another is looking at its invested capital, it is your job to both know that and adjust for it.

5. We conclude to a final value

Each indication of value from each method used, will provide a slightly different indication of value. That is normal and expected. Some methods ae simply more appropriate for certain types of projects than others. Some methods require significant adjustments to make them provide an accurate indication of value, and sometimes our underlying data is simply not as accurate as we would like it to be which will skew the results. In those cases, we need to exercise our judgement and explain how and why certain methods are less applicable and why we chose to either ignore, or place significantly less weight on certain of them.

6. We write our report

The communication of our reasonings and how we approached the appraisal problem, is just as much, if not more important then the actual numbers we used. Not only are our clients going to be looking for reasons why the concluded value is lower than they expected, so may our clients’ bankers, lawyers, spouse’s appraisal experts, potential buyers, and the occasional brother-in-law. If our reports do not clearly outline how we applied basic valuation theory, we may end up spending even more unpaid time answering questions that a little forethought on our part could have handled. (I do enjoy answering certain questions by telling the questioner what page of the report answers that particular question.)

Overall, valuation is fairly simple industry. We collect data, analyze it, draw conclusions, and then communicate our findings. Even those first few questions we ask our potential client about deadlines and appraisal purposes are gathering data so we can analyze and draw our conclusion of if we want that project or not. The basics are easy, but occasionally the details can become complicated.

If you have any questions you’d like to bounce off of a third-party, you can reach me at [email protected].

Your friendly neighborhood business appraiser,

Shawn Hyde, CBA, CVA, CMEA, BCA

March 4, 2021 - Forecasting

The value of an operating business is based on its expected future earnings. Many business appraisers have been used to relying on some sort of weighted average of historical operations, generally placing the most weight on the most recent year, in order to predict the future of a business. With the year 2020's COVID-19 impact, that method may no longer be as viable. 2020's results may not be indicative of future performance. Some businesses will take several years to recover from the loss of revenues, while others will slowly come back down to 'normal' operations. In any case, a business appraiser will have to consider that a weighted average of historical results is not the answer it used to be. We need to be able and willing to consider other alternatives to predicting the future.

The value of an operating business is based on its expected future earnings. Many business appraisers have been used to relying on some sort of weighted average of historical operations, generally placing the most weight on the most recent year, in order to predict the future of a business. With the year 2020's COVID-19 impact, that method may no longer be as viable. 2020's results may not be indicative of future performance. Some businesses will take several years to recover from the loss of revenues, while others will slowly come back down to 'normal' operations. In any case, a business appraiser will have to consider that a weighted average of historical results is not the answer it used to be. We need to be able and willing to consider other alternatives to predicting the future.

January 7, 2020 - Now I Will Have a Book Out